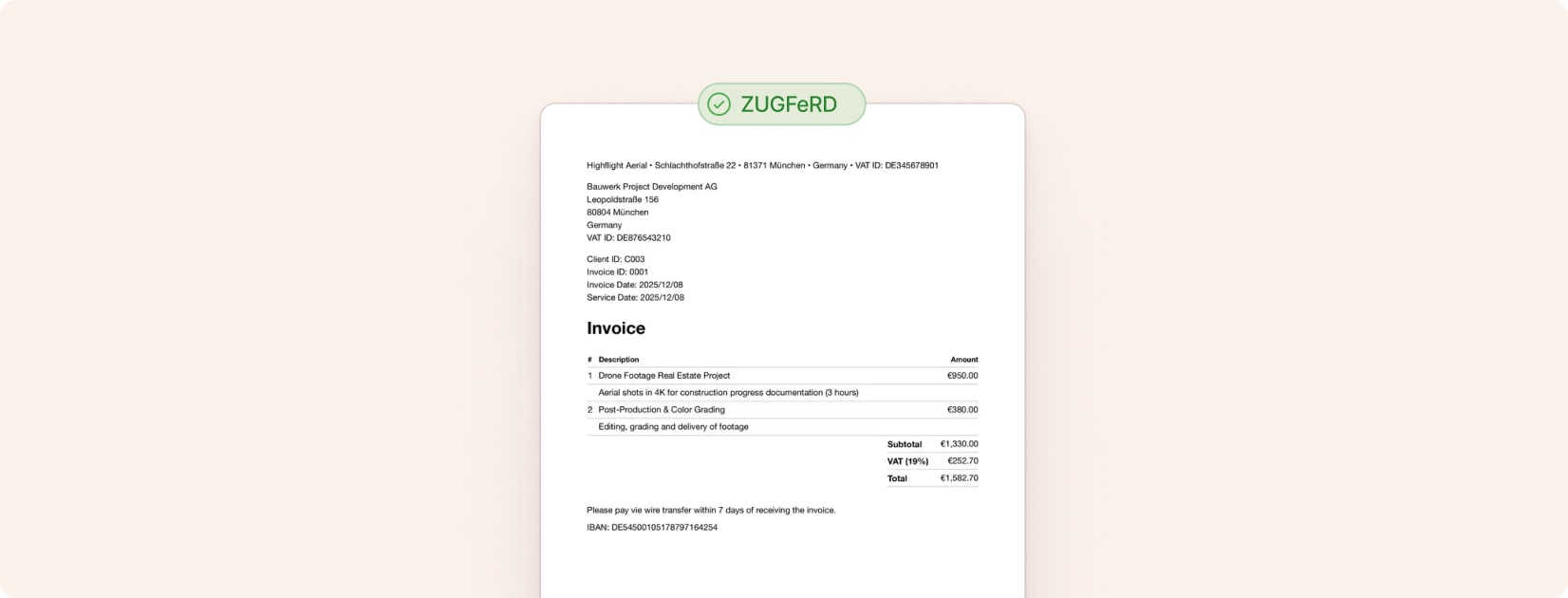

Create ZUGFeRD invoices for free

ZUGFeRD is the leading e-invoice format in Germany, combining a human-readable PDF with machine-readable XML data. With Cakedesk, you can create your first 3 ZUGFeRD invoices for free.

#What is ZUGFeRD?

ZUGFeRD (Zentraler User Guide des Forums elektronische Rechnung Deutschland) is a hybrid invoice format that embeds structured XML data inside a PDF/A-3 document. This means:

- For humans: The invoice looks like a normal PDF that you can read, print, and archive

- For machines: The embedded XML data can be automatically processed by accounting software

ZUGFeRD is based on the European standard EN 16931 and is fully compatible with Factur-X (the French equivalent). Starting January 2025, e-invoicing became mandatory for B2B transactions in Germany, making ZUGFeRD more important than ever.

#Why choose ZUGFeRD?

| Benefit | Description |

|---|---|

| Universal compatibility | Works as a regular PDF for recipients without e-invoice software |

| Automatic processing | Can be read and imported by accounting systems |

| Legal compliance | Meets German e-invoicing requirements |

| Long-term archiving | PDF/A-3 format ensures documents remain readable for decades |

#How to create ZUGFeRD invoices with Cakedesk

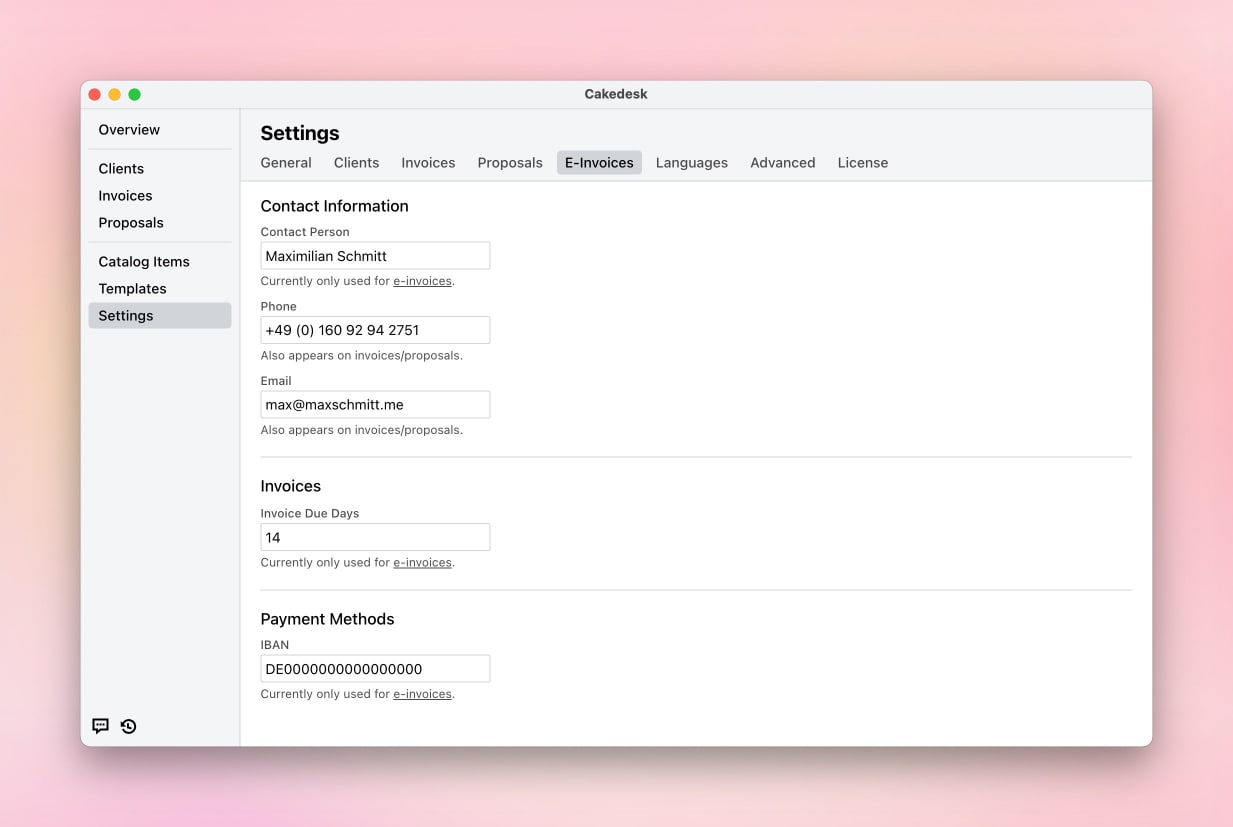

#1. Set up your e-invoice settings

Before creating your first ZUGFeRD invoice, configure your e-invoice settings under Settings > E-Invoices:

- Contact person name: Your name or your company's contact person

- Phone and Email: Contact details that will appear in the e-invoice data

- Invoice Due Days: Default payment term (e.g., 14 or 30 days)

- Bank details: Account holder, IBAN, and BIC for payment information

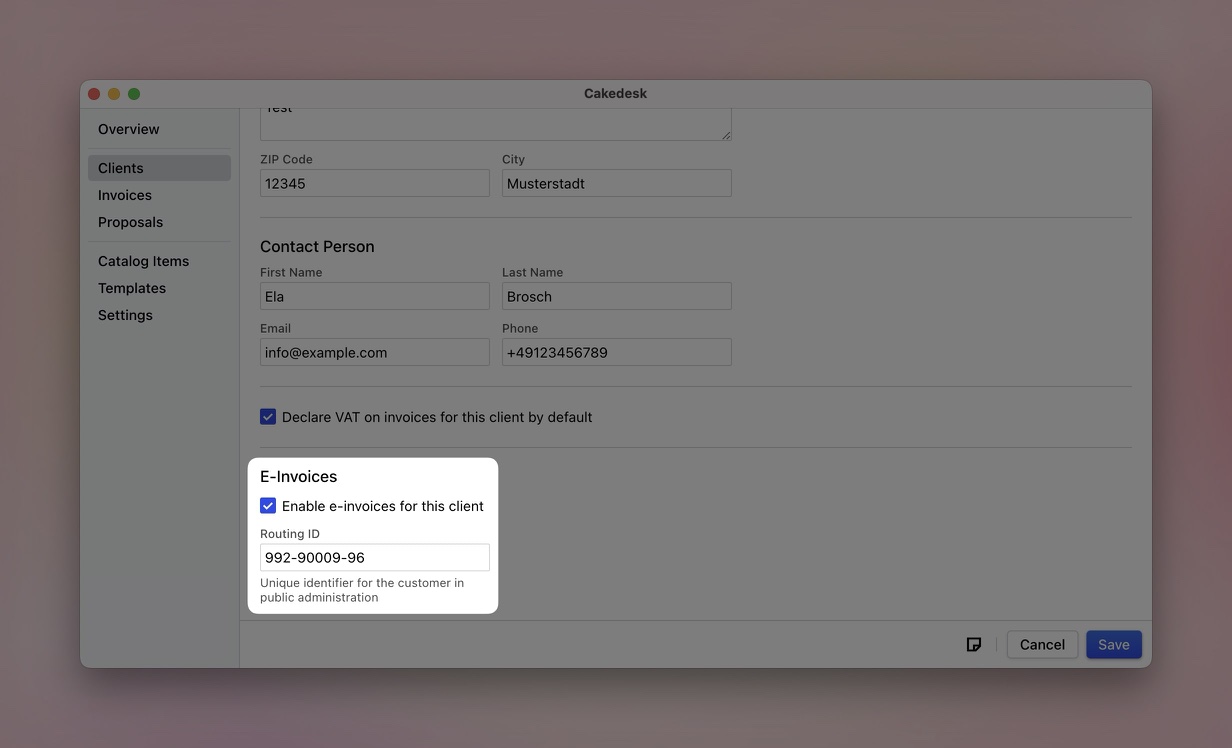

#2. Enable e-invoices for your client

Go to the client you want to invoice and enable e-invoicing:

- Open the client's details

- Scroll to the "E-Invoices" section

- Check the box "Enable e-invoices for this client"

- Optionally enter a Routing ID (Leitweg-ID) if your client is in public administration

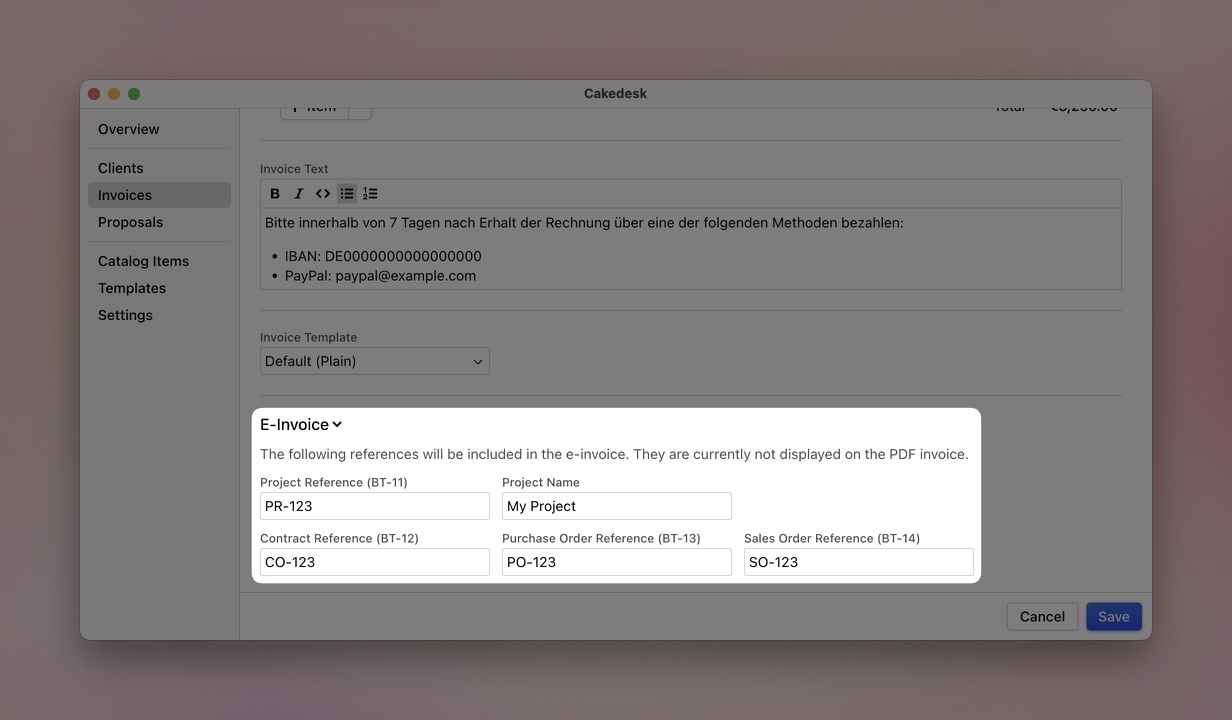

#3. Create your invoice

Create an invoice for this client as you normally would. When e-invoices are enabled for the client, you'll notice:

- The delivery date field is now required (mandatory for e-invoices)

- An E-Invoice References section appears with optional fields

For more complex invoicing scenarios, you can add reference fields:

- Project Reference (BT-11): Link the invoice to a specific project

- Contract Reference (BT-12): Reference an underlying contract

- Purchase Order Reference (BT-13): Include the buyer's PO number

- Sales Order Reference (BT-14): Add your sales order number

These fields are included in the XML data but don't appear on the visible PDF.

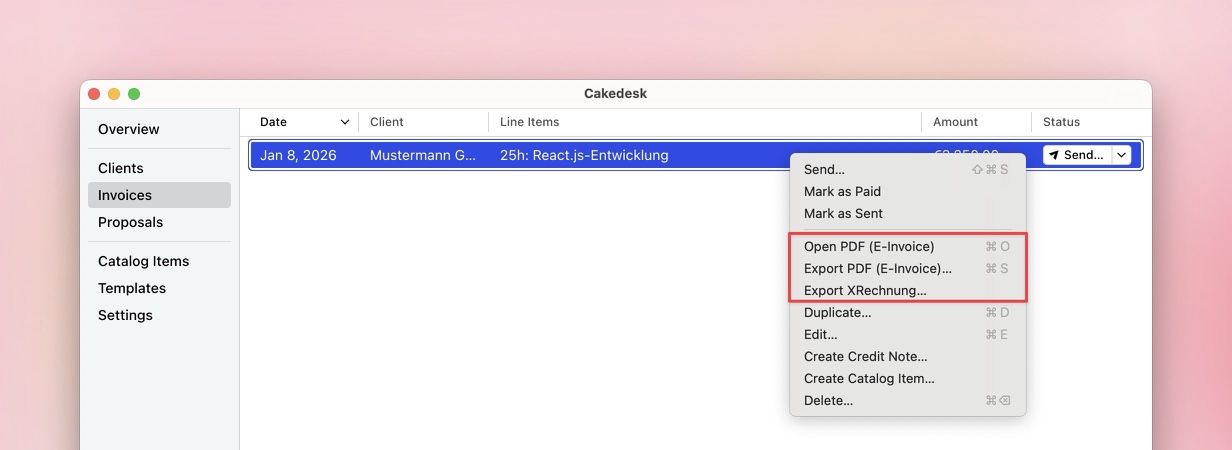

#4. Export your ZUGFeRD invoice

After saving your invoice, right-click on it to access the export options:

- Open PDF (E-Invoice): Opens the ZUGFeRD PDF directly

- Export PDF (E-Invoice): Saves the ZUGFeRD PDF to your computer

That's it! Your exported PDF now contains the embedded XML data that makes it a valid ZUGFeRD invoice.

#ZUGFeRD vs. XRechnung: Which format should you use?

Cakedesk supports both ZUGFeRD and XRechnung. Here's when to use each:

| Format | Best for | Output |

|---|---|---|

| ZUGFeRD | Most business clients (B2B) | PDF with embedded XML |

| XRechnung | German public administration (B2G) | Pure XML file |

Use ZUGFeRD when:

- Your client is a private business

- You want a visually appealing invoice that can also be processed automatically

- Your client doesn't specifically require XRechnung

Use XRechnung when:

- Your client is a government agency or public institution

- They explicitly require XRechnung format

- They provide a Leitweg-ID (Routing ID)

#Required information for valid ZUGFeRD invoices

To create a compliant ZUGFeRD invoice, make sure you have filled in:

#Your company details

- Company name and full address

- VAT ID or Tax ID

- Contact person, phone, and email

- Bank account details (IBAN, optionally BIC)

#Client details

- Client name and full address

- VAT ID (for EU business clients)

#Invoice details

- Invoice number and date

- Delivery date (when the service was provided)

- Payment due date

- Line items with quantities, prices, and VAT rates

#Verify your ZUGFeRD invoice

Want to make sure your ZUGFeRD invoice is valid? You can verify it using online tools:

- Open your exported ZUGFeRD PDF

- Upload it to a validator like elster.de

- The validator will extract and check the embedded XML data

#3 free ZUGFeRD invoices included

Cakedesk offers a free trial that lets you test all features, including ZUGFeRD e-invoices. The trial is limited to:

- 3 clients

- 3 invoices

- 3 proposals

This is enough to fully test the e-invoice functionality and make sure Cakedesk works for your business. Once you're ready to use Cakedesk for all your invoicing needs, you can purchase a license key for a low one-time payment to unlock unlimited clients, invoices, and proposals.

#Start creating ZUGFeRD invoices today

With Cakedesk, creating professional ZUGFeRD invoices is simple. Download Cakedesk and start sending compliant e-invoices to your German clients in minutes, there's no sign-up required.